When it comes to investing your money, it’s important to understand potential risks and how they can affect your portfolio. One such risk is something called the “max drawdown.” What exactly is it, and why is it important to know about?

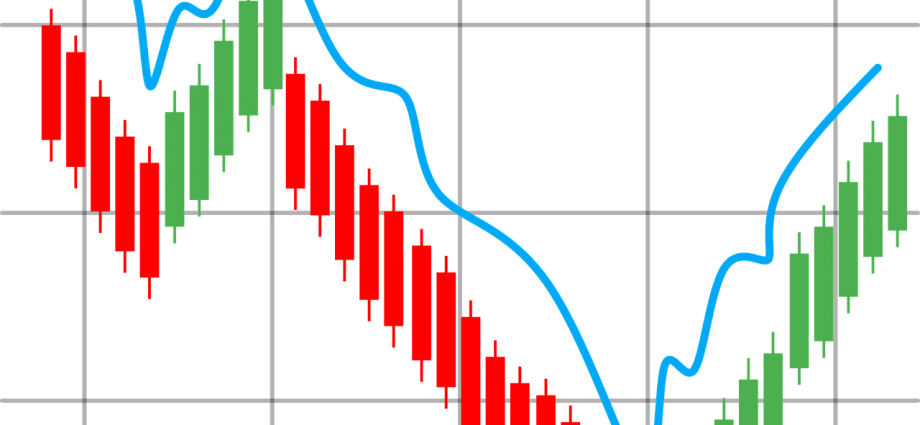

Max drawdown refers to the largest drop in value that an investment or portfolio experiences over a specific period of time. To put it simply, it represents the worst loss you could have experienced during a given period. Imagine you invested $100, and at one point, the value dropped to $80. That $20 loss is your max drawdown.

Knowing the max drawdown can help you understand the volatility of an investment. If an investment has a high max drawdown, it means it’s more likely to experience significant drops in value. On the other hand, an investment with a low max drawdown is generally considered less risky.

Why does this matter for investors? Well, it allows you to gauge how much risk you are willing to take. If you are someone who wants to play it safe, you might choose investments with lower max drawdowns. However, if you are comfortable with taking on more risk, you may opt for investments with higher max drawdowns, as they often have the potential for higher returns.

Remember, max drawdown is not the only factor to consider when evaluating an investment. It’s essential to look at other aspects, such as past performance, fees, and the overall market conditions. Additionally, diversifying your investments can help reduce the impact of max drawdown on your overall portfolio.

Max drawdown is a term used to describe the largest drop in value that an investment experiences over a specific time period.